Dec 17, 2025 | GroveStreet, In the News

GroveStreet Partner Bruce Ou and Redpoint Managing Director Logan Bartlett shared thoughts on the current state of AI and technology investing. The panel discussion was organized in NYC for a select group of investors to encourage open dialogue and an exchange of perspectives. To learn about GroveStreet’s insights into navigating long-term capital allocation in AI’s rapidly evolving landscape, click to schedule a meeting.

Dec 10, 2025 | GroveStreet, In the News

Meesho’s public market debut delivered a strong opening, signaling renewed investor confidence in India’s fast-growing e-commerce ecosystem and its next generation of consumer internet companies. The firm’s listing comes amid a broader wave of Indian tech offerings and highlights growing enthusiasm for scalable, low-cost commerce platforms that challenge incumbents like Amazon and Flipkart. For venture investors, Meesho’s IPO offers a data point that public markets may be reopening for well-positioned Indian startups with clear paths to growth and efficiency. Meesho has been an underlying GroveStreet portfolio company since 2017. To learn more about Meesho’s IPO and what it signals for India’s startup landscape, read the full article here.

Learn more about us or reach out to schedule a meeting.

Sep 1, 2025 | GroveStreet, In the News

So far in 2025, despite ongoing volatility and uncertainty in the broader landscape, GroveStreet has continued to deliver meaningful outcomes for our investors. On the venture side, several investments held through our partner funds reached transformative milestones: Google announced its $32 billion acquisition of Wiz; Meta acquired a 49% stake in Scale AI for $14.3 billion; and three additional companies – Figma, Circle, and CoreWeave – successfully entered the public markets. In parallel, our buyout portfolio has generated robust realizations, with year-to-date distributions suggesting that 2025 exit proceeds are on track to exceed historical averages for years that enjoyed more favorable exit environments. Lastly, as we return meaningful capital, we have remained focused on identifying and committing to the next generation of opportunities. Read more here.

Learn more about us or reach out to schedule a meeting.

May 12, 2025 | GroveStreet, In the News, Uncategorized

Artificial intelligence is bringing big changes to the workforce as companies redesign teams based on what work is best done by people versus what can be automated with technology. Moderna, for instance, has combined its tech and HR teams into a single unit, signaling a major shift in how it approaches workforce strategy in the age of AI.

Investors should closely monitor this trend as it continues to shape the addressable market for AI applications.

To learn more about how AI is reshaping workforce strategy, read here.

Learn more about us or reach out to schedule a meeting.

Apr 25, 2025 | GroveStreet, In the News

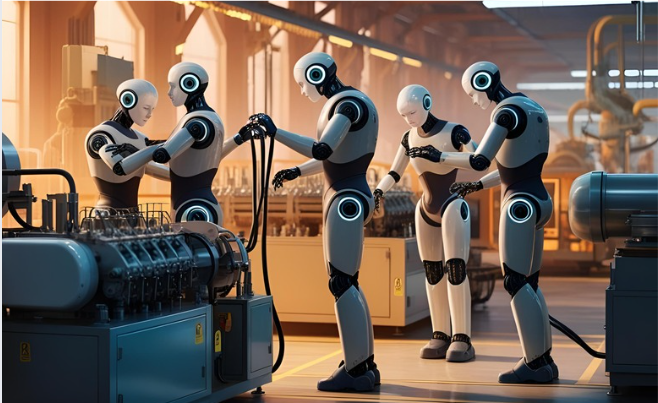

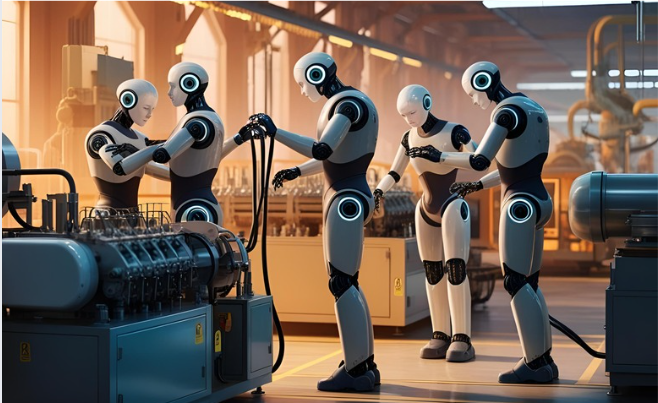

The fourth wave of AI marks a shift from digital agents to physical AI-powered robots, transforming industries through real-world automation. Following the first three AI waves of predictive AI (i.e., data analysis), generative AI (i.e., content creation), and agentic AI (i.e., taking actions), the robotics wave seeks to augment or replace humans in high-risk, labor-intensive sectors like field service, healthcare, and infrastructure.

Companies at the forefront of AI-driven robotics automation have the potential to become significant outcomes for venture investors, though they also pose new ethical and regulatory challenges as the technology scales. To learn more, read here.

Learn more about us or reach out to schedule a meeting.

Apr 3, 2025 | GroveStreet, In the News

Brynwood Partners exits Harvest Hill, a U.S.-based beverage manufacturer that develops, markets, and distributes a broad portfolio of juice and drink products across North America. Harvest Hill was acquired by Castillo Hermanos, a diversified business group that has presence in over 30 countries.

Harvest Hill was originally established in 2014 when Brynwood Partners acquired Juicy Juice from Nestle USA. Over the course of its ten-year investment, the Harvest Hill management team effectively identified, executed, and integrated several key strategic acquisitions including American Beverage Corporation, Sunny Delight Beverages, and Nutrament, assembling a portfolio of well-known beverage brands. GroveStreet first became a Brynwood LP in 2004. Read more about the deal here.

Learn more about us or reach out to schedule a meeting.