May 12, 2025 | GroveStreet, In the News, Uncategorized

Artificial intelligence is bringing big changes to the workforce as companies redesign teams based on what work is best done by people versus what can be automated with technology. Moderna, for instance, has combined its tech and HR teams into a single unit, signaling a major shift in how it approaches workforce strategy in the age of AI.

Investors should closely monitor this trend as it continues to shape the addressable market for AI applications.

To learn more about how AI is reshaping workforce strategy, read here.

Learn more about us or reach out to schedule a meeting.

Apr 25, 2025 | GroveStreet, In the News

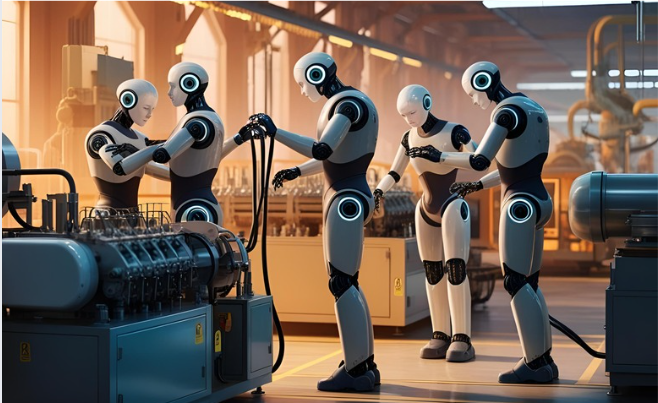

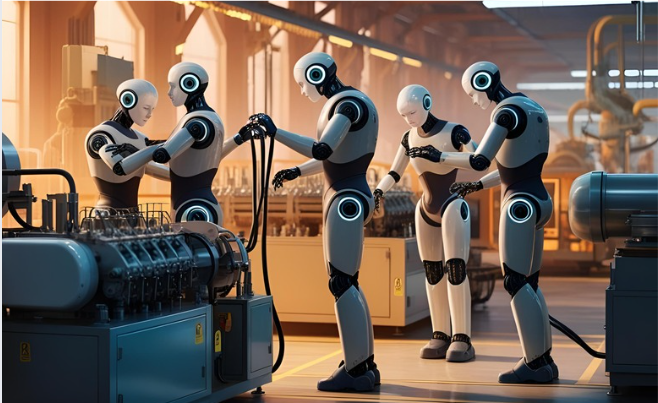

The fourth wave of AI marks a shift from digital agents to physical AI-powered robots, transforming industries through real-world automation. Following the first three AI waves of predictive AI (i.e., data analysis), generative AI (i.e., content creation), and agentic AI (i.e., taking actions), the robotics wave seeks to augment or replace humans in high-risk, labor-intensive sectors like field service, healthcare, and infrastructure.

Companies at the forefront of AI-driven robotics automation have the potential to become significant outcomes for venture investors, though they also pose new ethical and regulatory challenges as the technology scales. To learn more, read here.

Learn more about us or reach out to schedule a meeting.

Mar 21, 2025 | GroveStreet, In the News

Long Ridge Equity Partners exits NinjaTrader, a leading provider of high-performance trading software and self-directed brokerage services for active retail futures traders. NinjaTrader was acquired by Kraken, a leading U.S.-based cryptocurrency platform.

Long Ridge led a majority recapitalization of NinjaTrader in December 2019. Over the course of its five-year investment, NinjaTrader grew EBITDA by over 10x. Long Ridge augmented the company’s leadership team and board with industry veterans, drove growth initiatives such as increased marketing investments and international expansion, and executed multiple transformative acquisitions. GroveStreet first became a Long Ridge LP in 2012. Read more about the deal here.

Learn more about us or reach out to schedule a meeting.

Feb 12, 2025 | GroveStreet, In the News

Emerald Lake Capital Management exits Inno-Pak, a designer, manufacturer, importer and supplier of eco-friendly packaging for prepared and takeout foods. Inno-Pak was acquired by Handgards, a Wynnchurch Capital portfolio company.

Over the course of Emerald Lake’s 5-year investment, Inno-Pak strengthened its leadership team, built out its sales organization, more than doubled its patent portfolio, greenfielded its first scaled domestic production facility and opened an additional distribution center, and completed three strategic acquisitions to expand its product offerings, geographic presence, and manufacturing capacity. GroveStreet co-invested in Inno-Pak when Emerald Lake acquired the Company as an independent sponsor in February 2020. Read more about the deal here

Learn more about us or reach out to schedule a meeting.

Jan 31, 2025 | GroveStreet, In the News, Uncategorized

Europe has never had a stronger and deeper bench of entrepreneurs, with an increasing number of these individuals becoming venture capitalists. European deal activity has surged by an impressive 5.2 times in the past 10 years, outpacing the US and leading to the emergence of numerous unicorns that, in turn, have become launchpads for their employees to become the next generation of founders and venture capitalists. However, institutional investors should exercise caution as they weigh not only the compelling attributes but also the risks associated with the founder-turned-GP archetype. Managing Partners Mario Miranda and Patrick Sherwood provide valuable insights into navigating this rapidly evolving landscape. Read more here.

Learn more about us or reach out to schedule a meeting.